Structured Capital Strategies

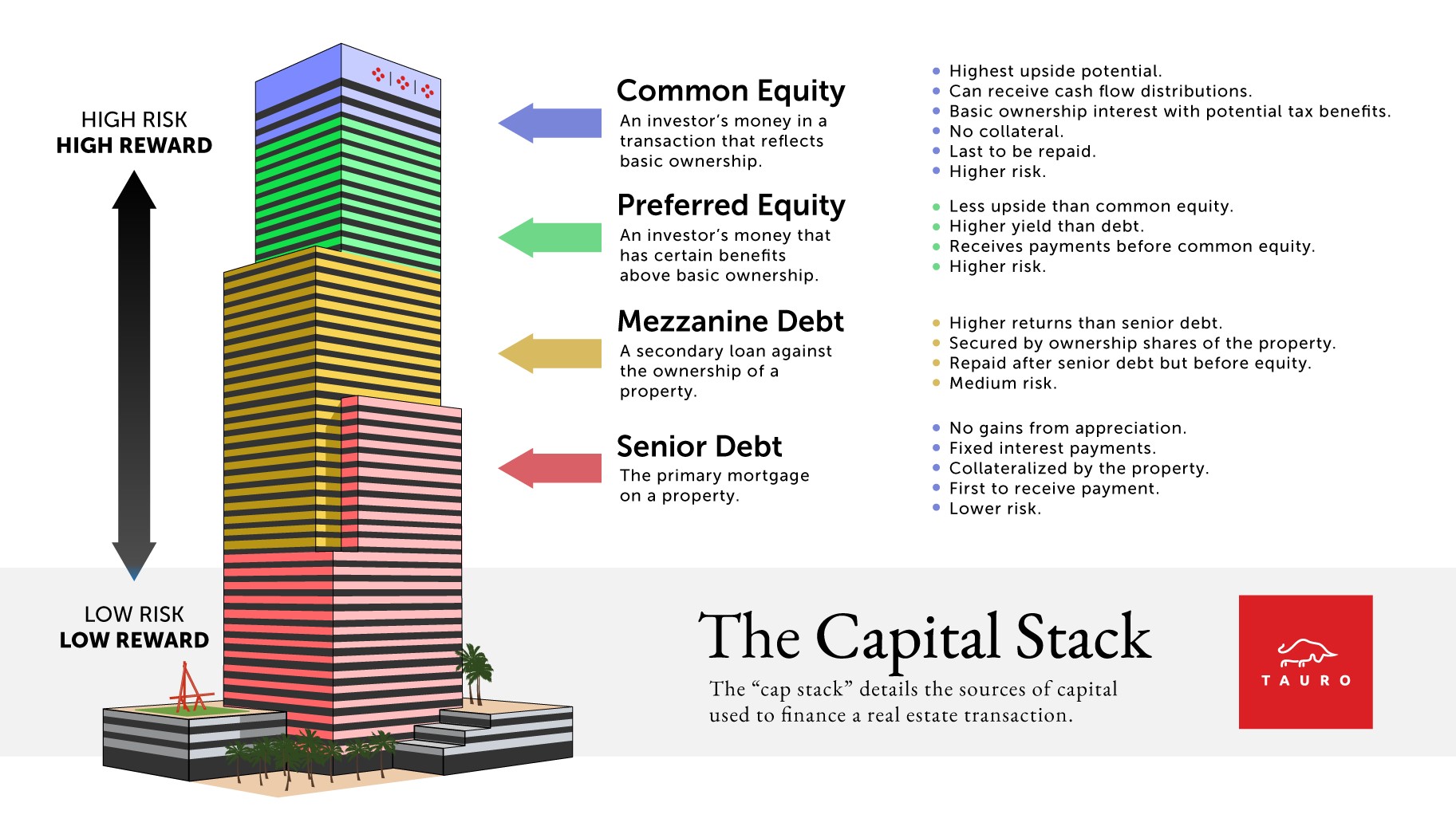

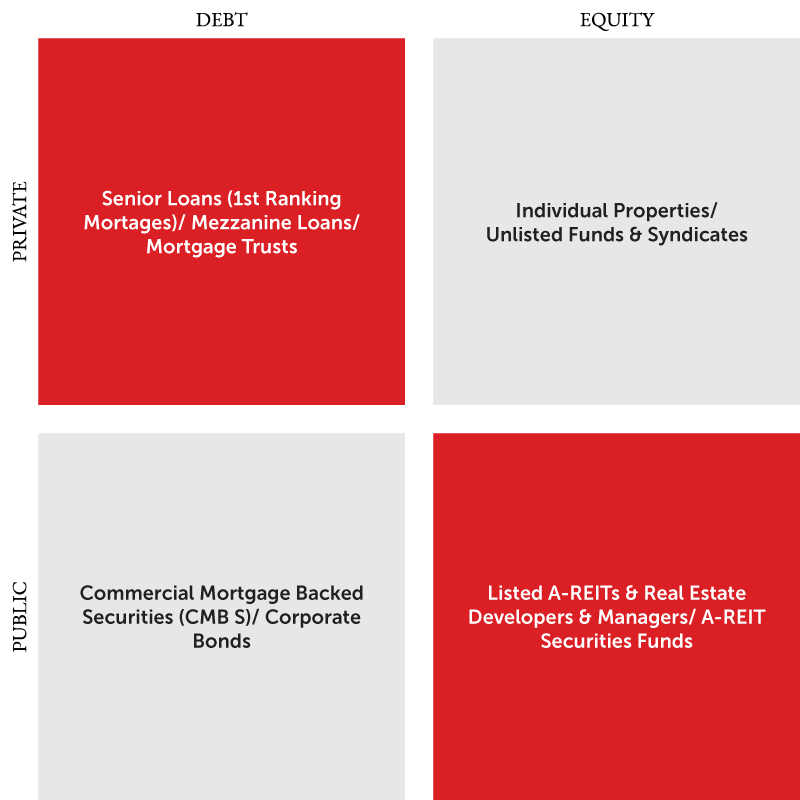

Tauro provides clients with creative commercial real estate advisory services by creating a market, specific to each client’s needs, with a diverse but focused group of capital providers. With an extensive database of over 3,000 debt and 850 equity investors, the ability of our commercial real estate consultants to find the right source of capital to fit a specific need is unparalleled. Whether clients are looking for senior debt, junior debt, or equity, Tauro has access to capital sources all over the world including institutional banks, insurance companies, government sponsored agencies, debt funds, pension funds and more. Dedicated like none other, Tauro’s advisors will exhaust every resource to make sure clients are fully taken care of. Our advisors work painstakingly to clarify a sponsor’s needs, underwrite property economics to systematically identify potential loan amounts and terms. Since capital relationships are important to Tauro, mitigation of lender/investor risk is a top consideration which leads to their extensive search for financing alternatives until they are able to fully define the right financing strategy.

It is best to think of Tauro as an outsourced CFO. For investors, this is an opportunity to grow business exponentially by having the commercial loan experts in your back pocket ready to help you make sound commercial real estate financing decisions.

Debt & Equity Placement

Tauro’s specialty is diversifying its commercial real estate advisory services so there are experts in all areas of debt and equity. When it comes to debt, there are advisors that specialize in capital solutions for acquisition, refinance, land/entitlement, construction, bridge, permanent, mezzanine, SBA, and PACE financing of commercial property. With JV equity, Tauro is no stranger to both common and preferred. With all this knowledge, Tauro advisors are confident when they bring the most competitive terms and executions to the table.

Tauro’s team of commercial real estate advisors has closed transactions of almost every commercial property type: multifamily, retail, office, industrial, hospitality, restaurant, owner user and more. Tauro has taken on and now specialized in a new property type that emerged during the pandemic – ghost kitchens. These off-site facilities have been instrumental for the food delivery business, and Tauro was one of the first commercial real estate advisory services to learn about and place both debt and equity for these new product types.

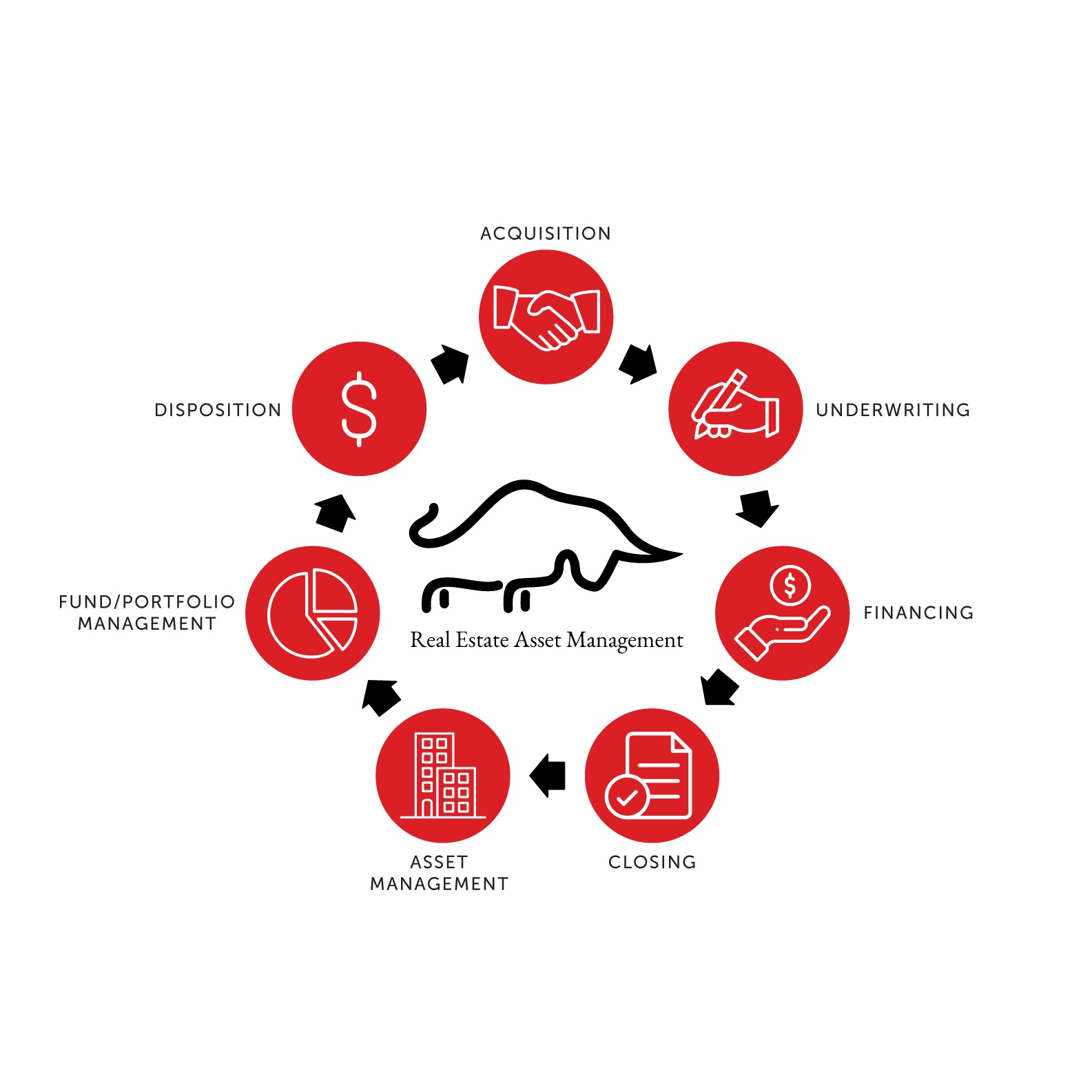

Real Estate Asset Management

Tauro’s team of commercial real estate advisors rely greatly on their resources in the Advisory Services team. This team, made up of analysts, processors, and project managers, works collaboratively alongside one another to do premier commercial real estate consulting. Acting as a fee consultant to evaluate real estate, analysts are able to assist tremendously in asset growth while taking into account asset performance, transactions and existing debt and equity. Tauro’s analysts' transaction underwriting and cash flow modeling is second to none. The processors on the team have streamlined an efficient and thorough due diligence gathering process drastically shortening closing timelines. Project managers maintain lender and investor databases constantly searching for more sources to meet clients’ ever-changing needs. Lastly, all members of this team keep sharp on their market knowledge by using real-time data and innovative technology to ensure they know how to be the best by balancing risk and return and maximizing cash flow.

Distressed Capital and Asset Strategies

Tauro’s asset management team also offers clients commercial real estate advisory services and strategies for distressed situations and asset preservation. By engaging the advisors and analysts of Tauro Capital Advisors, Inc. to provide commercial real estate consulting, the team can also provide support with litigation and bankruptcy. Fluent in all aspects of distressed debt, Tauro’s advisor and commercial real estate advisory services team are able to collaborate and map out various solutions. Tauro wants its clients to know our advisors will take the time to dig deep into the circumstances, clearly explaining the facts and advise on the best solution so the client feels heard, knowledgeable, and secure in their decision making.

Embedded Services

Tauro’s embedded services allows real estate investment sales or leasing companies with limited or no in-house commercial real estate financing or capital markets capabilities to expand services to their clients. With a dedicated Tauro Capital Advisor working at the embedded office up to four days per week the office can easily offer its clients a full array of financial servicing including debt financing, equity placement, structured finance, recapitalization strategies, and commercial real estate advisory services. With the combined power of the capital markets and advisory services teams, Tauro can analyze or underwrite even the toughest deal and advise on a strong financial strategy for offering memorandums or clients of the embedded office. Essentially, Tauro is a “plug and play” for an embedded office thus eliminating starting a capital markets team from scratch.

Tauro currently has two embedded offices: one in Sacramento with Capital Rivers Corporation and one in Phoenix with Kidder Matthews.