RecentFundings

$14,500,000 Permanent Loan for Acquisition of a Ground- Leased Shopping Center in Scottsdale, AZ

- Loan-to-Value: 62%

- Interest Rate: 5.6% Fixed

- Term: 7 Years

- Amortization: 25 years

Tauro Capital Advisors helped diversify a real estate investor’s portfolio by placing senior debt for the acquisition of a ground-leased multitenant shopping center in Scottsdale, AZ.

The Block at Pima Center is a Class A+ multitenant retail center comprised of 37,958 NRSF over four buildings on a 6.4 acre parcel, with 173 parking spaces. This trophy asset has a diverse mix of national and local tenants on long-term leases and is located within one of the premier entertainment destinations in the Southwestern U.S.

The assignment provided considerable challenges as the loan amount wasn’t simple to fund due to the fact that the property is located in the Salt River Pima Indian Community. However, due to Tauro’s considerable lender relationships, Tauro was able to identify one of the few lenders that had closed loans on the reservation land. Additionally, Tauro attempted to market the loan to lenders in a rising interest rate and deteriorating macro environment, along with the fact that lenders were weary of idiosyncrasies of the ground lease being that it was located on a Native American reservation.

$4,000,000 Loan for the Refinance of an 82-Key Comfort Inn & Suites in Midwest U.S.

- Loan-to-Value: 70%

- Interest Rate: 5.5%

- Term: 7 Years Fixed

- Amortization: 25 Years

Tauro Capital Advisors assisted a sponsor seeking perm debt to takeout an existing loan by sourcing a cash out refinance for a Comfort Inn & Suites in the Midwest U.S.

This Comfort Inn & Suites consists of an 82-key hotel covering 53,544 square feet. Amenities include a fitness center, business center, pool, and a meeting event space.

Tauro marketed this funding request during a rising interest rate environment all while the sponsor’s initial SBA loan spiked to 8%. Initially, the sponsor wanted to partner with its relationship bank. However, Tauro persevered by marketing the funding request to lenders in the local market. Ultimately, Tauro was able to source a loan at an interest rate well below the rate quoted by the sponsor’s relationship bank.

$2,500,000 Loan for the Construction of 155 Self-Storage Units in Southeast U.S.

- Loan-to-Vaule: 70%

- Interest Rate: UST3Y + 2.56% Fixed

- Term: 7 Years

- Amortization: 25 Years

Tauro Capital Advisors helped expand a self-storage construction company by placing a construction loan for the development of 155 self-storage units in the Southeastern U.S.

Although there was lender uncertainty about self-storage risks, Tauro sourced a cost consultant to help support higher appraisal results. Additionally, Tauro analysts researched the market to find proforma rents that were more than attainable with a growing interest in the product type post-Covid to secure a fair appraisal for the desired loan amount and terms.

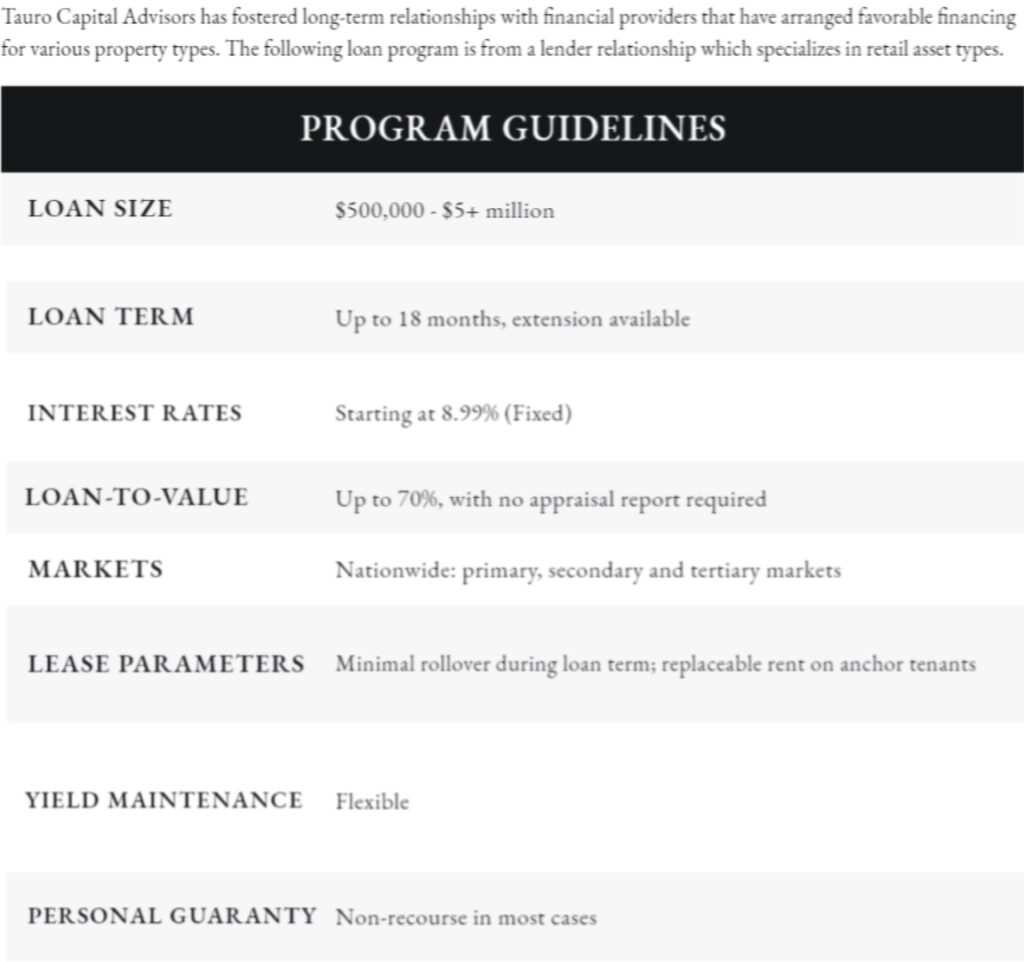

LenderSpotlight