RecentFundings

$20,250,000 Capital Stack for the Development of 2 healthcare provider facilities in Elk Grove, CA

- Senior Debt (LTC): $13,250,000 (65%)

- Junior Debt: $6,000,000

- JV Equity: $1,000,000

- Close Date: 8/14/2023

Tauro Capital Advisors, Inc. was exclusively engaged to place construction financing for the development of a WelbeHealth and a Fresenius Medical Care located in Elk Grove, CA. Tauro was tasked with building the entire capital stack consisting of senior debt, junior debt, and joint venture equity. The senior debt with a national lender was comprised of a $13,250,000 loan at 65% LTC. The term is 2 years interest-only at SOFR + 300 basis points with an option to fix at stabilization for 3 years at 3-year Treasury + 2.75% amortized over 25 years. Contact Tauro Capital Advisors for more information on the junior debt and equity.

The 39,250 square foot project sits on 5.25 acres and is 100% pre-leased/built-to-suit for the tenants. WelbeHealth is a PACE provider (Program of All-Inclusive Care for the Elderly) and Fresenius, a dialysis provider. Both are looking to expand services in the Sacramento area.

The Sponsor is a repeat Tauro client based in the area and continuing to develop properties nationwide.

$4,522,000 Cash-Out Refinance of a Multi-Tenant Retail Center in Phoenix, AZ

- DSCR: 1.15x (1.3x at Stabilization)

- Interest Rate: 6.50% Fixed

- Term: 5 Years

- Amortization: 25 Years

- Interest-Only: 9 Months

- Close Date: 7/25/2023

Tauro Capital Advisors, Inc. was exclusively engaged to place debt for the cash-out refinance of a multi-tenant retail center in Phoenix, Arizona. The Sponsor was looking to recapitalize a seller-carryback note with the intention of recapturing their original equity investment. Tauro secured financing that returned all of the Sponsor’s cash equity invested. The loan was sized to a 1.15x DSCR on in-place cash flow, and a 1.30x DSCR when including future income from incoming tenants. It carries a 6.50% fixed rate for 5 years with 9 months of interest only followed by a 25 year amortization. A flexible prepayment structure was also a key benefit, along with not having to provide borrower deposits.

The 22,000 square foot retail center was purchased during the middle of the pandemic, in mid-2020. Over the last 3 years, the Sponsor built a new single tenant building on the hard corner and have significantly increased the rental rate of the in-line space. The property sits directly in front of a well-located power center anchored by Costco.

The Sponsor is an experienced retail investment firm with a diverse portfolio of assets throughout the Phoenix market. Their expertise with value-add opportunities has delivered outsized returns for their investors.

$2,500,000 Bridge Acquisition and Development of an Entertainment District in the southern, US

- Loan-to-Cost: 100%

- Interest Rate: 13.75%

- Term: 12 Mos (12 mo extension option)

- Amortization: Interest-Only

- Close Date: 8/22/2023

Tauro Capital Advisors, Inc. was exclusively engaged to place a $2.5 million bridge loan for the acquisition and development of an entertainment district located in the southern US. Challenged with a very tight timeline and SFR conversions with little to no income, Tauro reached out to a longstanding relationship with a trusted bridge lender that agreed to use imputed land value to mitigate the lack of income and was able to close quickly. The loan is 100% LTC, 13.75% interest, 12 months term, interest-only with an option to extend another 12 months and no prepayment penalty.

The asset consists of 5.57 acres of contiguous land spread across 14 parcels and development will take place in phases. This project is part of the first phase in which five separate structures will be built. Four of the five properties are currently owned by the sponsor with the fifth under negotiation. The second phase will follow shortly.

The Sponsor is a real estate investment and land development company. They own several properties in this market, and the owner is an experienced commercial real estate investor with years of experience.

BullyPulpit

An interesting trend continues to hold true through economic slowdowns in the commercial real estate industry.

Smaller deal sizes outperform their larger counterparts in terms of both CMBS delinquency rates and sales volume.

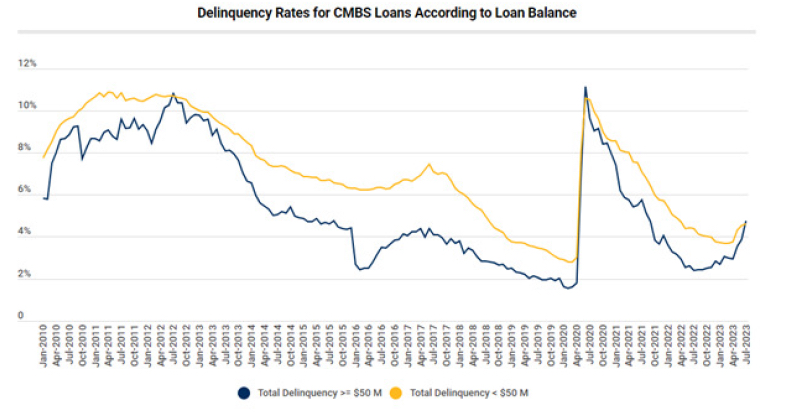

CMBS Analysis: The graph above illustrates the delinquency rates of CMBS loans categorized by loan balance. Historically, loans with balances below $50 million have generally exhibited higher delinquency rates (Trepp).

Interestingly, these two metrics have inverted three times in the past 13 years:

- July 2012: Aftermath of the Global Financial Crisis

- July 2020: Covid-19 Pandemic

- July 2023: Rise of interest rates

Sale Volume Analysis: A report by Green Street highlighted that property sales totaling $38.89 billion were recorded in the first half of 2023, marking a sharp decrease from the $55.12 billion of the previous year. When segmented by sale volume, sales in the $25 million-plus range witnessed a staggering 61% YoY drop, while the $5 million-to-$25 million bracket experienced a milder 29% fall.

The Tauro Takeaway: Based on CMBS delinquency rates and sales volume data, it is safe to conclude that periods of economic hardship present opportunities for the non-institutional buyer pool. Amid economic challenges, there is greater involvement of private buyers, including family offices, high-net-worth individuals, and syndicates. These investors, unaffected by institutional constraints, can adapt to high volatility as they await the market’s recovery. Currently, these buyers are favored, as banks may show a preference for smaller and more manageable deals with a reduced likelihood of delinquency.