RecentFundings

$6,000,000 Value-Add Acquisition Loan for a Multifamily Property in the Southern US

- Loan-to-Value: 80%

- Interest Rate: 9.5% Fixed

- Term: 6 Months

- Amortization: Interest-Only

Tauro Capital Advisors, Inc. was exclusively engaged to place acquisition and value-add financing for a multifamily property in the Southern US. The sponsor requested proceeds in an everchanging market for a property not in a primary location all on a strict timeline, Tauro was able to secure a loan at 80% LTV with a 9.5% interest rate over a 6-month, interest-only term. Given all the complexities, the lender was able to close in 9 days.

The apartment complex consists of 48-units. Construction was completed in early 2022, and the property is in the lease-up stage with 60% of the units currently occupied. The sponsor plans to spend $400K of CapEx on amenities (i.e. a dog park, covered picnic area, grilling station, and covered parking spaces) during final lease-up. The complex consists of 8 buildings with 6 units per building making for a total of 48 units. Total square footage is 40.2K square feet with the average unit size being 838 square feet. The location is just outside of a major metropolitan area.

The sponsor is an investment firm based out of Arizona that specializes in multifamily acquisitions. They have acquired seven assets since 2018 all through the South and Southwest US. The firm’s owner has strong financials which provided additional support and confidence for the lender.

$5,000,000 Loan for the Acquisition of Two Gage Dispensary Locations in the Northern US

- Loan-to-Value: 72%

- Interest Rate: 7.13% Fixed

- Term: 5 Years

- Amortization: 30 Years

Tauro Capital Advisors, Inc. was exclusively engaged to place a loan for the acquisition of two Gage Cannabis Dispensary assets in the Northern US. These acquisitions were part of a 1031-exchange. The tenant signed a 10-year absolute NNN lease commencing at the end of 2020. The Sponsor requested maximum proceeds and although debt for cannabis can be difficult to obtain, Tauro was able to source a lender that would go up to 72% LTV even with an environmental concern with one of the properties.

The properties consist of roughly 4,000 square feet each. They were built to suit for the tenant with construction finishing right before move-in. The region is one of the largest cannabis markets in the US, and the properties are near retail sectors in college towns.

The Sponsor is a single investor experienced in multifamily and NNN retail ownership. His portfolio is estimated to be upwards of $12M. With a high net worth and considerable liquidity, Tauro was able to get this sponsor attractive terms with a midwestern credit union. Furthermore, the tenant has a corporate guarantee, and they have a strong presence in the region with plans to open more locations.

$1,500,000 Loan for the Acquisition of an Apple Market Convenience Store and Shell Fueling Station along the East Coast

- Loan-to-Value: 58%

- Interest Rate: 6.55%

- Term: 10 Years

- Amortization: 30 Years

Tauro Capital Advisors, Inc. was exclusively engaged to place a $1.5M loan for the acquisition of a property comprised of a convenience store and fueling station in the eastern US. Challenged with a short closing deadline along with minimal Sponsorship net worth and liquidity, rendered a low probability of success. Tauro reached out to a long-standing lender relationship with whom the firm has closed similar situations and that was comfortable providing the loan request.

The property has a 13-year, absolute NNN lease in place with Apple Market Gas that commenced mid-2022. It sits along a main thoroughfare in the area with a car count over 23K vehicles per day. Additionally, the property location benefits from proximity to a large metropolitan area and a major retail sector surrounded by multiple big-box stores.

The Sponsor is in the early stages of his investing career, and this property is the second in his portfolio. Outside of real estate, he is a business owner who owns operates a convenience store. Without the property financials, the Sponsor accessed funds on a home equity line of credit which provided the lender additional support and gave the Sponsor better terms than originally quoted.

BullyPulpit

When I graduated college in May of 2021, the 10-year treasury was 1.5%.

At the time I was working in acquisitions, and debt pricing was rarely taken into consideration.

Fast forward, and I check the treasury yield every day. This is because I’ve learned how treasury yields have direct implications on CRE values.

Explained in one context, when treasuries rise, investors shift capital allocations over to treasury bonds to benefit from higher risk-free returns. Accounts created on TreasuryDirect.gov increased 426% in 2022 YoY.

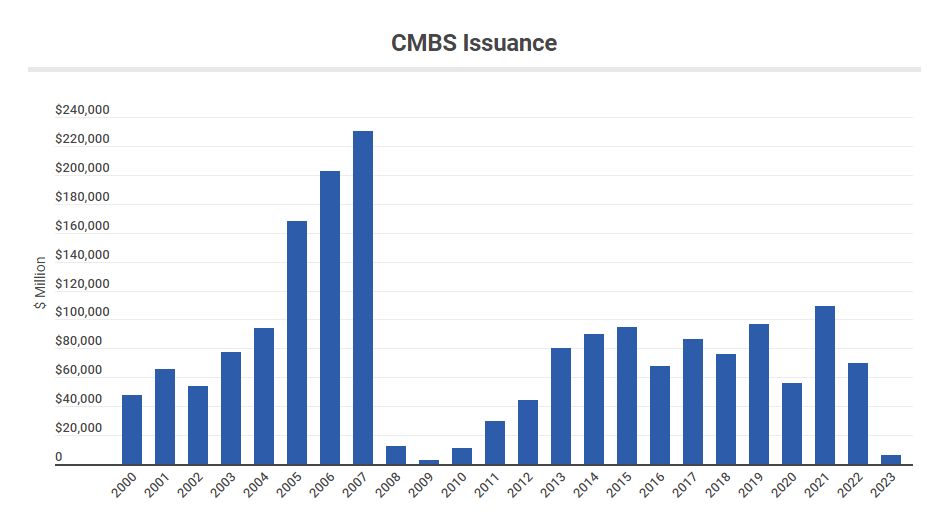

This means that other fixed income products such as CMBS take a back seat.

Total CMBS issuance during the first quarter of 2023 totaled a mere 10 transactions, down more than 79% from the same period a year ago. The last time quarterly volume was as low was in 2012, following the GFC. (Trepp)

The drop in CMBS issuance has resulted in fewer financing options and lower liquidity in the CRE market. The US Treasury yield curve predicts a peak in rates 4 months from now, it will be interesting to see how it plays out!